Market measures: How can tech companies 'hack' their growth?

Our latest online survey of 318 Kiwi tech companies delivered a bunch of data across all aspects of how they take their innovations to global markets. We crunched the data and come up with nine hacks you can use to fuel growth in your tech company.

- Hack 1 Hold marketing's feet to the fire

- Hack 2 Get out more

- Hack 3 Turn your website into something useful

- Hack 4 Do more content marketing, but don't be boring

- Hack 5 Use marketing technology, consider HubSpot

- Hack 6 Grease your funnel

- Hack 7 Don't be so low tech

- Hack 8 You need more sales people

- Hack 9 Love your customers

- Download the full report

Hold marketing's feet to the fire

Compared to our US counterparts we don’t generate a high enough proportion of leads from marketing, leaving too much for the sales teams to do. Generating quality leads from marketing campaigns, and ensuring your marketing and sales teams work together effectively, lowers your overall cost of sale.

What's the problem?

Marketing aren't generating enough qualified leads

For the average Kiwi tech company, marketing needs to do a better job at delivering qualified leads to the sales team.

The contrast with the US experience is stark. Kiwi sales people have to do a whole lot more of the leg work when finding and nurturing sales opportunities than their US counterparts.

There’s no real difference for the high growth companies in the survey; they’re still heavily dependent on what we identified in our 2015 survey as the talented ‘lone wolf’ sales person who is driving most of the activity.

Too many of our Kiwi sales teams are having to find their own sales leads through referral and cold calling.

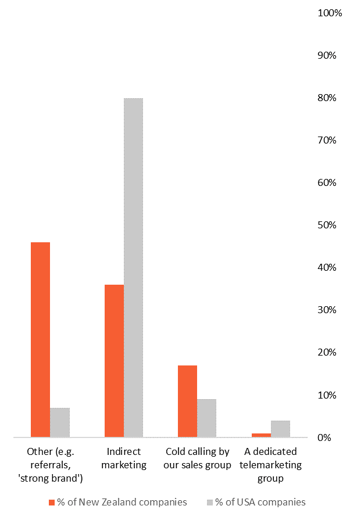

Primary source of marketing leads (% of New Zealand companies vs. the US)

In the survey, indirect marketing (e.g. email campaigns, advertising, social media, etc.) was the primary source of sales leads for 36% of companies, compared to 80% in the US.

What's the solution?

Drive better alignment across marketing and sales

Sales efficiency is about building an in-house or outsourced marketing function that is focussed on generating qualified leads, that can be closed at a lower cost by sales.

Growth comes from making marketers responsible for generating qualified leads for sales, and for sales to commit to processing those effectively.

“Don't let good leads go cold through inactivity.”

Market Measures respondent

This alignment means marketing commits to a number and quality of leads required to hit company revenue goals, while sales commit to the speed and depth of lead follow-up that makes economic sense.

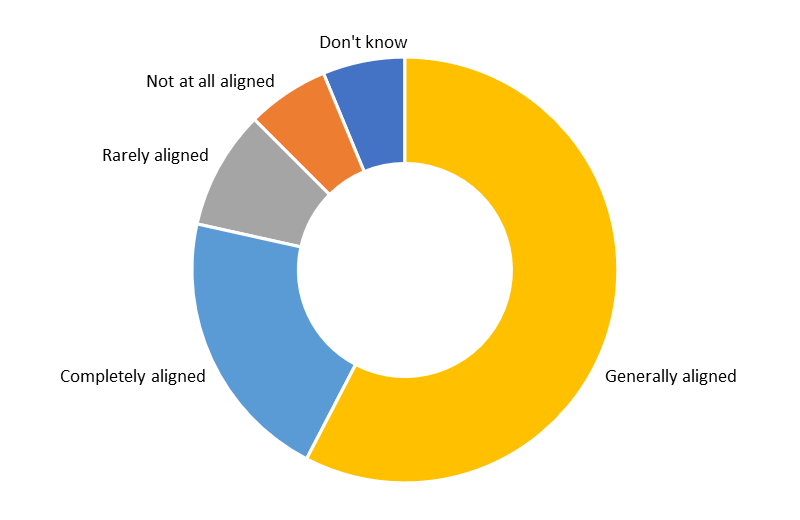

Ultimately alignment is defined and agreed as a Service Level Agreement (SLA) between marketing and sales. 21% of companies in the survey believe they have complete alignment between sales and marketing.

“Ensure the hand-off of leads from marketing to sales is automated and seamless.”

Market Measures respondent

High growth companies in the survey show better alignment than the average.

Only 7% of high growth companies in the survey showed a lack of alignment, compared to 18% for all other companies.

High growth companies also have a higher proportion of completely aligned marketing and sales teams, which typically includes having a SLA in place.

Sales and marketing relationship (% of companies)

Ultimately alignment is defined and agreed as a Service Level Agreement (SLA) between marketing and sales. 21% of companies in the survey believe they have complete alignment between sales and marketing.

Get out more

The Market Measures survey found that high-growth companies (87%) are significantly more likely to export than the average (64%), treading the well-worn path to Australia and North America. The logistics and cashflow challenges of exporting can be overcome by being laser-focussed on your target markets.

What's the problem?

We're not aggressive enough about exporting

We are a nation of exporters, and it is no different in the technology sector. Our innovations are found across the globe in every sort of application.

An average of 69% of companies in the survey sell their products and services outside New Zealand.

Companies exporting outside New Zealand (% of companies)

%20Table.png?width=380&name=Companies%20exporting%20outside%20New%20Zealand%20(%25%20of%20companies)%20Table.png)

While the typical US technology company can build a large business on a regional or even state-wide basis, Kiwi firms must go offshore early to achieve growth. In previous Market Measures surveys we’ve found the large majority of firms export, and they do so relatively early in their growth cycle.

In the survey 23% more high growth firms are operating offshore than non-high growth companies. The growth dynamic of exports markets is clear.

“You need to spend at least some of your time in the markets you are selling into.”

Market Measures respondent

What's the solution?

Choose the smallest profitable niche in Australia or the US, and go hard.

The most common approach for tech exporters is to build momentum and cashflow in New Zealand, start moving offshore into Australia and then launch into the US. The key underlying principle is the larger the market, the more laser-focussed you need to be.

66% of exporting companies in the survey are selling into North America (includes Canada and the United States), accounting for 26% of their export revenue.

Export markets (% of companies)

%20Graph.png?width=480&name=Export%20markets%20(%25%20of%20companies)%20Graph.png)

Focus means consciously selecting a market, i.e. a set of connected businesses with a similar level of buying interest (not necessarily by geography, it could equally be by industry or some other factor), and concentrating your sales and marketing activity on it.

Focus also means saying no to potential business. Selecting a market isn’t easy. When you’re striving hard to grow and expand, it seems counterintuitive to reject sales opportunities, but the reality is the wider you choose to spread your marketing effort the less effective it will be.

“Be very, very focussed.”

Market Measures respondent

Even in the Australian market, most Kiwi tech companies need to take a selective approach to market entry, identifying a realistic niche that they can dominate before moving to the next.

Turn your website into something useful

Your digital channel should be delivering a good number of regular leads, but the survey found that 43% of us don’t even monitor what our website is doing, let alone understand whether it’s effective. Your website should be the hub of lead generation activity, converting around 4% of traffic to leads.

What's the problem?

Digital isn't generating enough leads

Growth comes from generating leads for your sales teams. A significant proportion of that are leads that come through your digital channels, primarily your website.

The survey found that 26% of Kiwi companies are focussed on growing website traffic as one of their two main marketing priorities, compared to 54% of US companies.

Where tech companies do track website visitor numbers (a significant 44% don’t), they are performing well at the lower end converting visitors to leads. In the survey companies with 1,001 to 2,000 website visitors achieved a 4.3% lead conversion rate.

This compares favourably with one of the biggest benchmark studies in this area, from HubSpot, which sets a 5% website visitor to lead conversion as a good benchmark.

However, we struggle at converting effectively beyond the 2,000 unique visitor per month mark

Tech companies need to understand that their website is the hub of their lead generation efforts. All other activities should include the website as the place to drive potential customers and start supporting people on their buying journey. Obviously, the more transactional your business (e.g. SaaS) the more critical this is.

Website visitor to lead conversion rate (% of website visits)

%20Graph-1.png?width=595&name=Website%20visitor%20to%20lead%20conversion%20rate%20(%25%20of%20website%20visits)%20Graph-1.png)

The survey showed that the average website visitor to lead conversion for companies averaging 2,001 to 5,000 website visits was 1.3%.

What's the solution?

Make quality traffic growth a priority, and measure it.

Simply tracking your website data is the place to start.

Use Google Analytics or a similar tool, and start measuring on a monthly basis your traffic and where it comes from (i.e. organic search visits, direct URL visits, social media visits, email link visits, paid search visits).

“Online marketing is the best.”Market Measures respondent

44% of companies in the survey don’t know how many website visitors they have in a month.

If you are tracking the numbers, a 4% website visitor to lead conversion is a reasonable target. A large MIT study put the average visitor to lead conversion ratio at 1-3%. HubSpot’s benchmark is 5%.

Quick tips for website marketing effectiveness:

- Clean, functional design focussed on user experience.

- User friendly CMS that marketing can drive.

- Regular blogging and content production schedule.

- Review your metrics monthly.

Content marketing tactics used (% of companies)

Do more content marketing, but don't be boring

If you are not engaging with your buyers digitally, you risk becoming invisible. It’s important to provide them with useful content to help them on their journey. Where we can learn from the US is generating more types of content, and providing it to buyers across a broader mix of channels.

What's the problem?

We're too conservative with our content marketing.

Content marketing (i.e. the distribution of educational and/or compelling content in multiple media formats to attract and/or retain customers) is an established weapon in the tech marketer’s arsenal. Buyers of technology solutions expect useful information to help them all the way along their buying journey, not just product data.

Kiwi tech firms have embraced content marketing, with the majority doing some form of it. The trouble is we’re a little boring about it, sticking to a narrower set of content types than US companies.

“Create decent content, with true insight and value.”

Market Measures respondent

Content marketing tactics used (% of companies)

%20Graph.png?width=400&name=Content%20marketing%20tactics%20used%20(%25%20of%20companies)%20Graph.png)

What's the solution?

You can manage what you measure.

Two keys to being innovative with your content marketing are planning and measurement.

“Do your customer personas and journey mapping if you haven't already.”

Market Measures respondent

Fundamental to content marketing success is building a consistent plan of output, aimed at distinct ‘personas’ (target audiences) across all stages of their buying process (from initial problem awareness through to purchase decision), using a variety of methods and publication channels.

The most effective way to do this is by focussing on the persona’s core business problems (e.g. competitive pressure, operational efficiency, growing revenue, etc).

The other key is measuring the response to understand what sort of content, e.g. video, case studies, blogs, eBooks - works across the available publication channels (e.g., social media, email, organic search, paid searches). Visibility to content and channel performance gives you confidence to invest in the approaches that work.

“Don't overspend resources on marketing that is not effective.”

Market Measures respondent

The biggest opportunity is video, which is exploding as a way of communicating with prospects, whether through your website, social media channels or more direct approaches like email.

Video is the preferred channel for content. According to a recent global survey, 54% of consumers preferred video for brand or business-related content.

We are also ‘boring’ when it comes to the channels we use to share our content. There are large gaps between our planned adoption of mainstream platforms like YouTube or Instagram compared to US companies.

In the survey, 14% of companies planned to add Facebook video as a content distribution channel compared to 41% in the US.

Content channels to be added in the next 12 months (% of New Zealand companies vs US)

%20Graph.png?width=500&name=Content%20channels%20to%20be%20added%20in%20the%20next%2012%20months%20(%25%20of%20New%20Zealand%20companies%20vs%20US)%20Graph.png)

Use marketing technology, consider HubSpot

Improving your digital marketing is down to using technology. As technologists we know software helps increase efficiency and improve visibility to data, but the survey found that 47% of companies don’t use marketing automation tools. There are over 6500 ‘martech’ products on the market, but you only need a couple to make real progress. Of the companies that do use marketing automation technology, they use a product called HubSpot by an overwhelming margin.

What's the problem?

We aren't getting enough out of our marketing spend.

Kiwi tech firms typically invest aggressively in sales and marketing. The challenge is getting the most out of that investment, something we are not sufficiently focussed on.

15% of companies in the survey put ‘proving the ROI of marketing activities’ as a top priority in the next 12 months, compared to 42% in the US.

Marketing automation technology (software that exists with the goal of automating marketing actions such as emails, social media, and other website actions) helps tech firms build and run marketing programs more efficiently, and makes the results much more visible.

“Invest in marketing by at least 25-30% of revenue.”

Market Measures respondent

The survey showed that 53% of companies are using marketing automation, with HubSpot being the platform of choice by some margin.

They are many options for automation technology, from basic free solutions through to powerful and expensive enterprise platforms. HubSpot seems to be a good fit for the typical Kiwi tech business as a platform that is relatively easy to apply and can be scaled up.

Use of marketing automation software platform (% of companies)

%20Graph.png?width=601&name=Use%20of%20marketing%20automation%20software%20platform%20(%25%20of%20companies)%20Graph.png)

According to the survey, 50% of companies produce software products or SaaS, but 47% don’t use marketing automation in their own business.

What's the solution?

Choose a marketing technology stack.

According to chiefmartech.com there are 6,829 marketing technology solutions from 6,242 unique marketing technology vendors. Fortunately, you don’t need them all.

The key categories are:

- A website Content Management System (CMS) that is widely used, well supported by the vendor or partners, and is easy for marketing people to use when managing content. It should include the ability to easily add content landing pages and conversion forms.

- Marketing automation software that makes it easier to perform key tasks like email distribution, list management, and lead scoring. It should also be able to collect intelligence on leads, support email nurturing and lead analytics.

- Content delivery tools to support blogging, social media publication, remarketing and paid ad management.

“Automate as much as possible.”

Market Measures respondent

Grease your funnel

Growth is about really understanding how your customer acquisition funnel works and then streamlining it. This was a priority for 10% of Kiwi companies, against 30% of US firms. 43% of us don’t know our lead to customer conversion ratio. The hack is to really understand how buyers find and buy your product, and how you can systemise this process as much as possible.

What's the problem?

We need to be more focused on sales efficiency.

The survey found that only 10% of Kiwi firms have ‘reducing the cost of generating new contacts, leads and customer acquisition’ as a marketing priority in the coming year, compared to 29% of US companies.

Selling Kiwi tech is typically a complex, lengthy process with an average sales lead time of 5.8 months. Not surprising, given 86% of us sell B2B.

What is surprising is that almost half (43%) of companies surveyed didn’t know their lead to customer conversion rate, a key part of their sales funnel.

The less you know about the funnel, the harder it is to drive alignment between marketing and sales, hold marketing especially accountable, and achieve ongoing improvement in the way you market and sell.

“Develop a sales focus. Engage the whole team in a sales approach.”

Market Measures respondent

For those that did track it, the average lead to customer conversion rate is 38% and for high growth Kiwi companies even higher.

This compares favourably with larger US benchmark studies which put average lead to customer conversion rates anywhere from 2% to 10%.

A high rate is not necessarily a cause for celebration though, given almost 40% of survey respondents put ‘productivity and performance’ as their top challenge in managing account and sales teams over the coming year.

While our sales teams convert at a high rate, there is frustration amongst Kiwi tech companies at the inability to scale that into high sales volumes.

What's the solution?

Building your sales ‘system’.

In this survey, 63% of sales people, with variable compensation, achieve their sales quota, which is consistent with 68% for US companies.

However, US firms achieve this when their average experience required for a new sales hire is considerably less (1.4 years in the US compared to 5.1 years in New Zealand).

The difference is a more systemic and process oriented approach to sales in the US. As the graph on the following page shows, US firms are significantly more focussed on ramping and onboarding, motivation and ongoing training of their sales people than we are in New Zealand.

Their less experienced, less expert sales people can perform at a similar level to our teams because they are supported with more of a sales ‘system’.

“Work on sales enablement materials, so once the region is ramped up the sales team has everything at their finger tips to drive growth.”

Market Measures respondent

Achieving the same quota with less experienced sales people suggests Kiwi firms could do more to implement systems and processes to support their sales teams.

Top two challenges in managing account management and sales teams (% of companies)

%20Graph.png?width=621&name=Top%20two%20challenges%20in%20managing%20account%20management%20and%20sales%20teams%20(%25%20of%20companies)%20Graph.png)

Don't be so low tech

Again, technology is the key to making your sales team more efficient. The average Kiwi tech sales person has 3.4 quality sales conversations per day, as against the high-growth group with 4.9 and US 5.1. This is mirrored in the level of technology use where US tech firms will use 4 sales enablement technologies (e.g. email automation and tracking) compared to high-growth Kiwi businesses with 2.9 and the rest 1.9.

What’s the problem?

We need to increase sales productivity.

While there are many indicators of sales productivity, number of quality conversations is a useful metric commonly used in US sales teams.

Quality sales conversations are defined as a connect call or response where the sales person learns at least one piece of qualifying or disqualifying information.

In the survey, sales people had 3.4 quality conversations per day compared to 5.1 in the US (33% less conversations).

For high growth Kiwi companies the average was much closer to the US figure, at 4.9 quality conversations per day.

“Pick up the phone. Personal contact is the single most effective way to achieve cut-through.”

Market Measures respondent

Top two challenges in managing account management and sales teams (% of companies)

%20Graph.png?width=500&name=Top%20two%20challenges%20in%20managing%20account%20management%20and%20sales%20teams%20(%25%20of%20companies)%20Graph.png)

What’s the solution?

Use technology to drive efficiency.

As any good tech company knows, a major benefit of many tech tools is increased productivity. We don’t invest enough in that for our own sales teams.

On average, US tech companies will use 4 sales enablement tools per team. In the survey, high growth Kiwi companies use 2.9 and the rest 1.9.

Technologies used by sales team (% of companies)

%20Graph.png?width=350&name=Technologies%20used%20by%20sales%20team%20(%25%20of%20companies)%20Graph.png)

CRM software platform (% of companies)

%20Graph.png?width=300&name=CRM%20software%20platform%20(%25%20of%20companies)%20Graph.png)

16% of firms still don’t use a Customer Relationship Management system (CRM), the building block of any marketing technology. Of those that do, HubSpot is again the most popular choice.

“Get a CRM early, get coaching, follow up on leads even if you think it's been too long.”

Market Measures respondent

You need more sales people

Really, you do. High-growth companies employ 40% more sales people than the remainder, adjusted for company size. And those sales people tend to be more mid-level and junior personnel. The key is having the right systems and support in place to help your sales team become more effective, and efficient.

What’s the problem?

The average Kiwi tech company is under-resourced in sales.

In the survey, Kiwi high growth companies have 40% more sales people than non-high growth companies, across all company sizes.

New Zealand’s tech industry has been built on a generation of highly talented ‘lone wolf’ sales people who travel the world sourcing customers for their innovations. Technically competent, business savvy and converting at a high rate describes the classic lone wolf. They are also expensive and can’t be easily scaled.

To scale more effectively Kiwi tech needs to be able to build structured, repeatable sales processes that enable a bigger number of lower level sales people to sell effectively.

“Both sales and marketing have a deep understanding of who our company is fit to provide value to.”

Market Measures respondent

Sales team capability (average makeup of team)

%20Graph.png?width=500&name=Sales%20team%20capability%20(average%20makeup%20of%20team)%20Graph.png)

What’s the solution?

Less ‘lone wolves’ and more pack members.

According to the survey, high growth Kiwi companies have the same number of sales managers but significantly more sales personnel overall (adjusted for company size).

Capability within the sales team (average number of people)

%20Graph.png?width=401&name=Capability%20within%20the%20sales%20team%20(average%20number%20of%20people)%20Graph.png)

First sales hire in export markets (% of companies)

%20Graph.png?width=400&name=First%20sales%20hire%20in%20export%20markets%20(%25%20of%20companies)%20Graph.png)

Consequently they require less experience on average. In the survey the average experience required for a new sales hire is 5.1 years, compared to 4.5 years for high growth firms.

The survey showed that companies tended to employ more experienced people as their first hire in export markets.

Increasing your number of sales people isn’t straightforward. Do you have the money, are the right people available to hire, where should they be located and so on?

What the data shows is that high growth companies are more aggressive in their hiring, and tend to have more of the systems in place to enable less experienced sales personnel to deliver effectively.

“Stay real, be personal and never give up.”

Market Measures respondent

Love your customers

While it may seem obvious in one sense, the importance of customer success is often underestimated in modern marketing and sales. The rise of digital marketing is making good customer experiences even more important to growth, as buyers’ trust in traditional company information is diminishing. People want real-life, authentic examples of customer success.

What’s the problem?

Trust is harder to earn.

Digital marketing has enabled companies to reach potential customers far more easily and at a lower cost than ever before. The flip side has been diminishing trust in these messages.

Recent HubSpot data shows:

- 81% trust their friends’ and family’s advice over advice from a business.

- 55% no longer trust the companies they buy from as much as they used to.

- 65% do not trust company press releases.

- 69% do not trust advertisements, and 71% do not trust sponsored ads on social networks.

Marketers and sellers have tended to focus on generating and closing leads, almost forgetting about the importance of the end result – ensuring customers are successful with our product or service.

“Keep the customers that you have buying more. It is easier to retain than to gain.”

Market Measures respondent

And while always a foundation of business success, customers are taking on greater importance for marketers in the digital age.

Because people have access to so much information about products and companies, they can educate themselves completely online, and are less likely to be persuaded by marketing. Increasingly what they need amongst all this noise is a trusted endorsement or referral from an existing customer – whether that’s from online reviews or direct conversations. These are becoming more and more important.

As tech marketers and sellers we need to make sure we pay attention to the experience of our customer.

What’s the solution?

Realise customer success drives growth.

Doing a good job for your customers is becoming your best marketing tactic, especially for SaaS businesses.

A key step is to measure customer satisfaction rigorously, with Net Promoter Score (NPS) being the most common method. In the survey NPS was up slightly (42 vs. 40 in 2017).

“Focus on NPS, referrals and automate back end systems.”

Market Measures respondent

The biggest difference in the survey was between high growth SaaS companies who had an average NPS of 44, compared to other SaaS companies who had an NPS of 37.

New Zealand’s smartest tech companies are now leveraging satisfied customers as a marketing tool, using their experience to drive new business.

Loving your customers equals growth.

Benchmarks

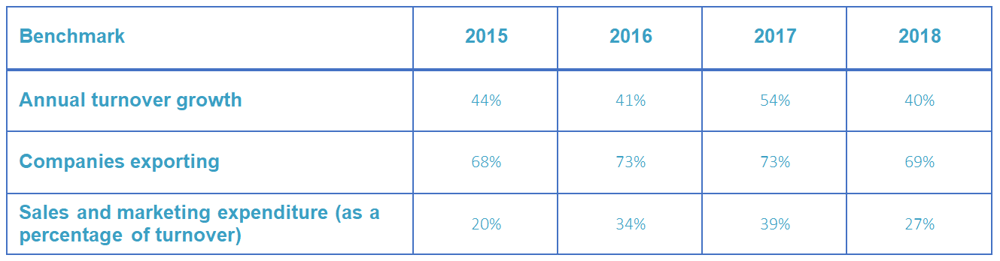

Key Market Measures benchmarks

Sales and marketing expenditure (as a % of turnover)

%20Table.png?width=751&name=Sales%20and%20marketing%20expenditure%20(as%20a%20%25%20of%20turnover)%20Table.png)

Sales and marketing spend includes sales and marketing staff expense, and non-staff marketing expense (e.g. promotion), and is expressed as a percentage of turnover.

The benchmarks

The nine growth hacks identified in this study have emerged from benchmarking the survey data against two groups:

- A subset of high growth New Zealand companies that participated in the survey

- Similar report data from the US.

High-growth New Zealand companies

Throughout the Market Measures study “high growth” companies are compared to other survey respondents.

High growth companies are determined using a methodology developed by the Bridge Group, Inc, where the fastest-growing companies are identified per revenue band. In the survey, turnover growth was used to mark companies as being in the top 20% of companies in each turnover band. These companies are referred to as “high growth”.

High growth companies by turnover band (% of companies)

%20Graph.png?width=612&name=High%20growth%20companies%20by%20turnover%20band%20(%25%20of%20companies)%20Graph.png)

US benchmark information

US data used in these benchmarks was taken from five different sources. The Bridge Group, Content Marketing Institute, HubSpot, Capterra and Softletter.

Market measures report

Download the report now

You may also like

-1.png?width=5500&height=4000&name=Concentrate%20-%20Blog%20Hero%20Images%20(4)-1.png)

HubSpot Feb 2026 updates: Concentrate’s top picks

The rise of the anti-social B2B buyer