Ask Achan: Best practices for key account management within Hubspot

Ask Achan: Best practices for key account management within Hubspot

June 26, 2025

5

min read

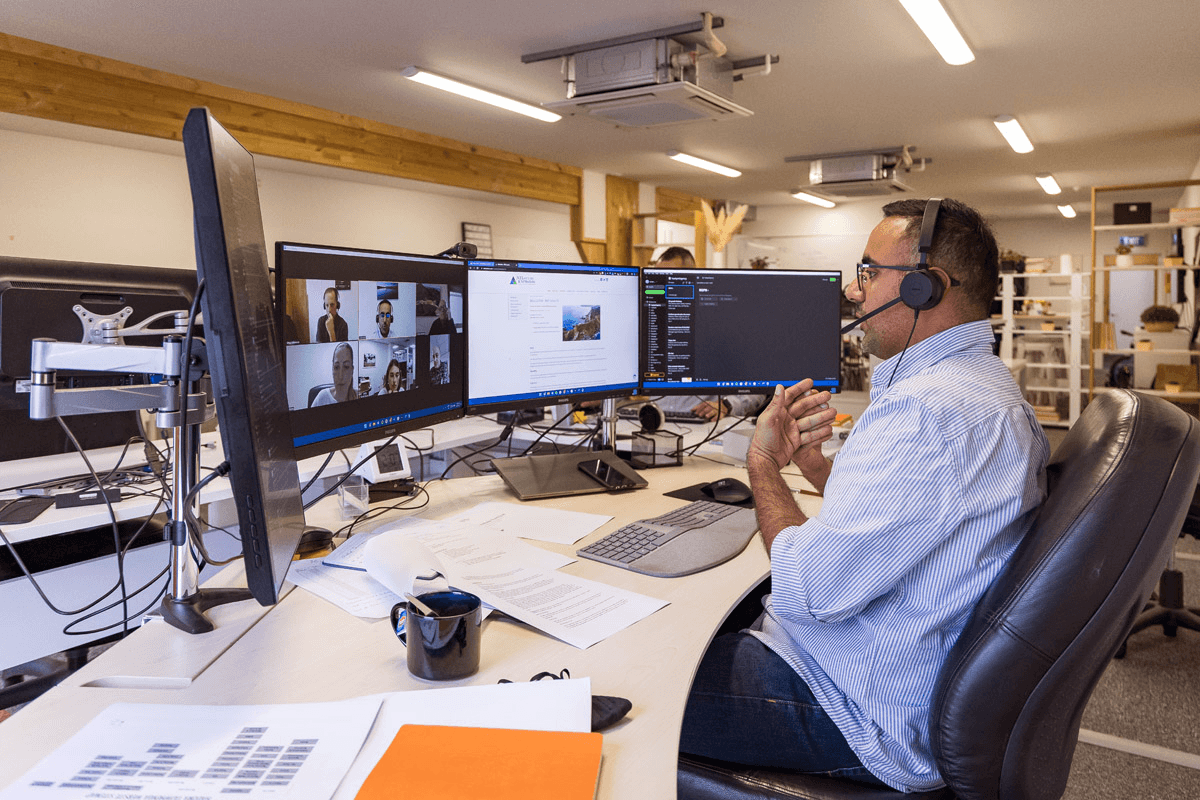

Ask Achan: What tools have you successfully integrated with HubSpot?

Ask Achan: What tools have you successfully integrated with HubSpot?

May 21, 2025

5

min read

HubSpot April 2025 Updates: Concentrate’s Highlights

HubSpot April 2025 Updates: Concentrate’s Highlights

May 20, 2025

3

min read

HubSpot March 2025 Updates: Concentrate’s Highlights

HubSpot March 2025 Updates: Concentrate’s Highlights

April 16, 2025

3

min read

Ask Achan: Creating dashboards that deliver

Ask Achan: Creating dashboards that deliver

April 16, 2025

4

min read

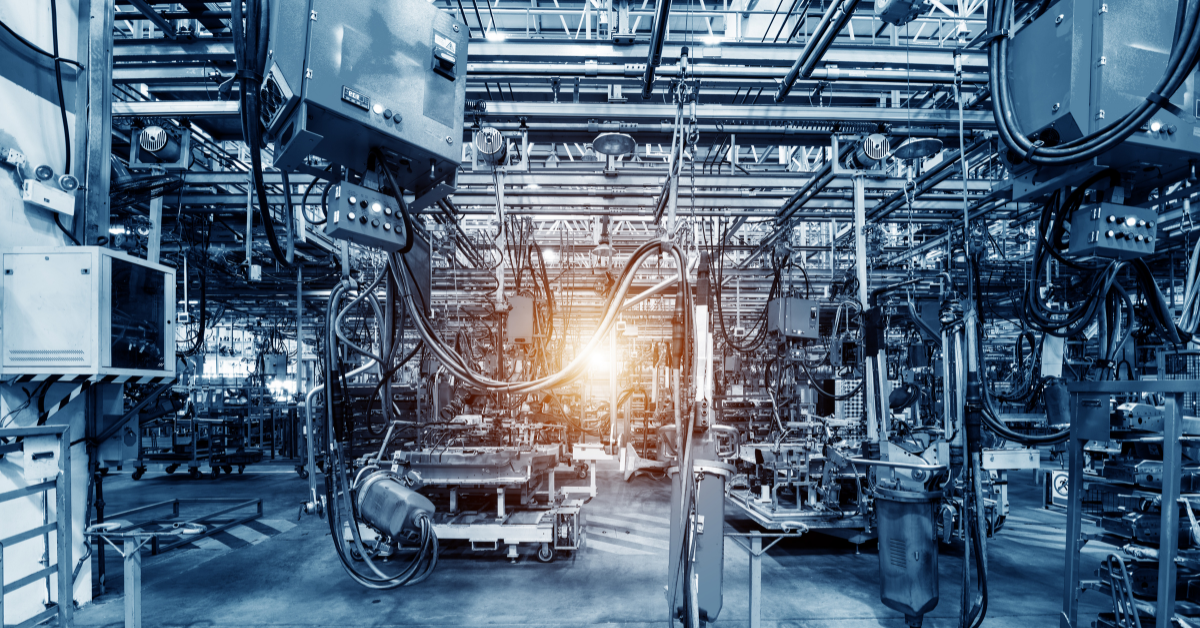

Supercharge Your Manufacturing Revenue

Supercharge Your Manufacturing Revenue

April 10, 2025

7

min read

Concentrate on, mastering first-party data

Concentrate on, mastering first-party data

March 19, 2025

5

min read

Ask Achan: Which HubSpot features do you think are underrated and why?

Ask Achan: Which HubSpot features do you think are underrated and why?

March 18, 2025

3

min read

HubSpot February 2025 Updates: Concentrate’s Highlights

-Mar-13-2025-04-47-21-2857-AM.png?width=3000&height=2000&name=Concentrate%20-%20Blog%20Hero%20Images%20(1)-Mar-13-2025-04-47-21-2857-AM.png)

-Mar-13-2025-04-47-21-2857-AM.png?width=3000&height=2000&name=Concentrate%20-%20Blog%20Hero%20Images%20(1)-Mar-13-2025-04-47-21-2857-AM.png)

HubSpot February 2025 Updates: Concentrate’s Highlights

March 18, 2025

2

min read